Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

By Oluwakemi Kindness

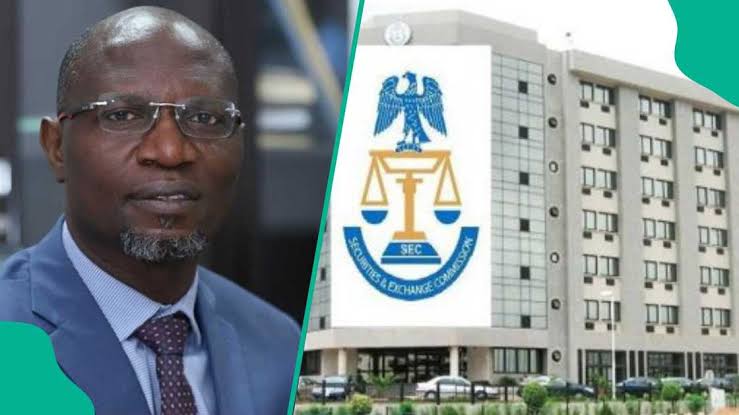

The Securities and Exchange Commission (SEC) has announced plans to significantly scale up enforcement actions in 2026 following the enactment of the Investments and Securities Act (ISA) 2025.

It said this move aims at strengthening investor confidence and safeguarding market integrity.

The Director-General of the SEC, Dr. Emomotimi Agama, disclosed this while outlining the Commission’s regulatory priorities, noting that the new law has expanded the Commission’s supervisory and enforcement powers.

Agama said the Commission would apply the enhanced powers “firmly and impartially” to tackle market abuse, insider dealing, fraudulent investment schemes and other forms of misconduct within the capital market.

“With the enactment of the Investments and Securities Act 2025, the Commission’s supervisory and enforcement framework has been strengthened. In 2026, the Commission will continue to apply these powers firmly and impartially,” he said.

According to a statement on Sunday by the Commission, all enforcement actions would be guided by due process and the rule of law, adding that predictable and consistent regulation remains critical to building trust among investors.

According to him, the enforcement drive forms part of broader efforts to strengthen market integrity, efficiency and resilience, noting that confidence in the capital market depends on effective supervision and the consistent application of rules.

Beyond enforcement, Agama said the Commission plans to improve regulatory efficiency through increased digitalisation, including streamlined approvals, automated filings and enhanced disclosure processes.

“These measures are intended to reduce unnecessary frictions, improve regulatory responsiveness, and enhance transparency across the market,” he emphasized.

The SEC, he added, will also introduce enhanced disclosure standards, including environmental, social and governance (ESG) reporting, alongside a structured recapitalisation and governance review of market intermediaries to promote financial resilience and sound risk management.

On investor protection, Agama reaffirmed the Commission’s commitment to balancing broader market access with strong safeguards, particularly for retail investors and small and medium-sized enterprises (SMEs).

Looking ahead, he said the Commission remains focused on supporting Nigeria’s economic transition while maintaining market discipline.

“We will regulate not to stifle, but to catalyse. We will enforce not to punish, but to protect and build trust,” Agama stated.

He also disclosed plans to roll out a nationwide financial literacy programme in 2026 aimed at improving investor awareness and reducing vulnerability to fraudulent schemes.

Written by: Democracy Radio

#DemocracyRadio #Emomotimi Agama #SEC

Similar posts

Copyright Democracy Radio -2024