Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

By Oluwakemi Kindness

Former Speaker of the House of Representatives, Yakubu Dogara, has emphasized that Nigeria’s new tax reforms will only succeed if citizens trust the government to deploy resources responsibly.

Speaking at the inaugural Distinguished Parliamentarian Lecture organized by the House of Representatives Press Corps, Dogara said: “True tax reform is not about raising rates, it is about raising trust.

Transparency is the engine of compliance. When citizens can see where their naira goes, they are proud to give it.”

Dogara stressed that taxation should be viewed as a pact between government and the people. “If we contribute diligently, government must deploy those resources responsibly to build roads, power industries, build world-class hospitals, and educate our workforce,” he added.

On the contentious 5% fuel surcharge, he clarified that it is not a new levy but a restatement of the 2007 Federal Roads Maintenance Agency Act, adding that essential household energy products like kerosene, cooking gas, and CNG are exempt.

The lecture also highlighted the new requirement for unified Tax Identification Numbers (TINs), which Dogara said would simplify compliance, close loopholes, and broaden the tax net, ultimately supporting Nigeria’s drive toward a self-reliant and globally competitive economy.

Supporting the reforms, Executive Director of the Civil Society Legislative Advocacy Centre (CISLAC), Auwal Musa Rafsanjani, urged the Federal Government to unify Nigeria’s tax system, eliminate multiple taxation, and ensure fairness, particularly for women and vulnerable groups.

“We have seen so many agencies of government; everyone wants to be a tax collector. A unified, transparent system is urgently needed,” he said, noting that wealthy individuals must also contribute their fair share.

Speaker of the House of Representatives, Tajudeen Abbas, represented by Akin Rotimi Jnr, commended President Bola Tinubu’s bold reforms, describing them as a decisive step to simplify compliance, broaden the tax net, and reduce burdens on ordinary Nigerians.

Abbas praised the National Assembly’s rigorous review of the legislation, including stakeholder consultations and committee work, and reaffirmed the 10th House’s commitment to open governance through live-streaming, digital portals, and citizen engagement.

The Speaker also highlighted the legislature’s enduring support for press freedom, outlining principles for journalists to strengthen democracy, including reporting objectively, rejecting fake news, holding officials accountable, and promoting unity and peace.

“Press freedom in Nigeria is not negotiable,” he declared, urging the media to partner with government in fostering transparency and safeguarding human rights.

Representative of the Chairman of the Federal Inland Revenue Service (FIRS), led by Special Assistant on Tax Policy, Olufemi Olarinde, reinforced the importance of media collaboration in communicating tax reforms.

“If we must enlighten the public about these reforms, it is important that journalists first understand them fully,” he said, promising technical support and resources to aid accurate reporting.

Lawmakers, including Jafaru Leko, also expressed support for the reforms, citing VAT exemptions for small businesses, joint revenue collection initiatives, and measures to boost transparency and economic growth.

Chairman of the House Press Corps, Gboyega Onadiran, noted that taxation remains a contentious issue in Nigeria, with multiple narratives surrounding petroleum taxes, data levies, and the use of NINs for banking operations.

He said the lecture provides a critical platform to clarify policy, simplify legislative processes, and foster informed public discourse.

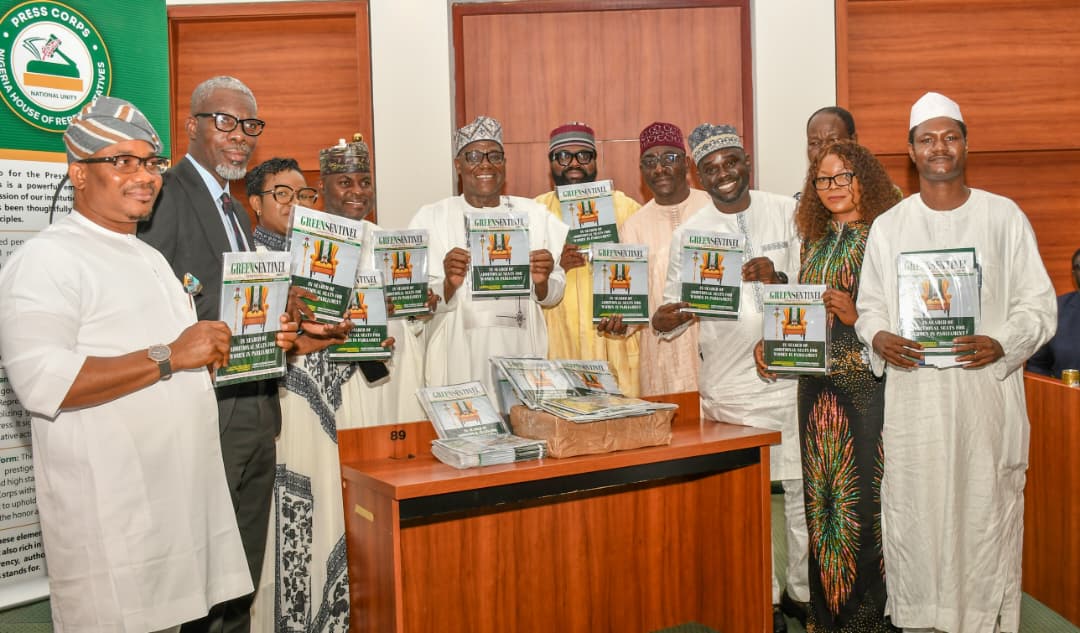

The inaugural lecture, delivered by Dogara, was hailed as a landmark initiative bridging the gap between legislators, journalists, and the public, reinforcing the importance of trust, transparency, and accountability in advancing Nigeria’s fiscal and democratic agenda.

Written by: Democracy Radio

#DemocarcyRadio #House of Reps #Tax reforms

Similar posts

Copyright Democracy Radio -2024