Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

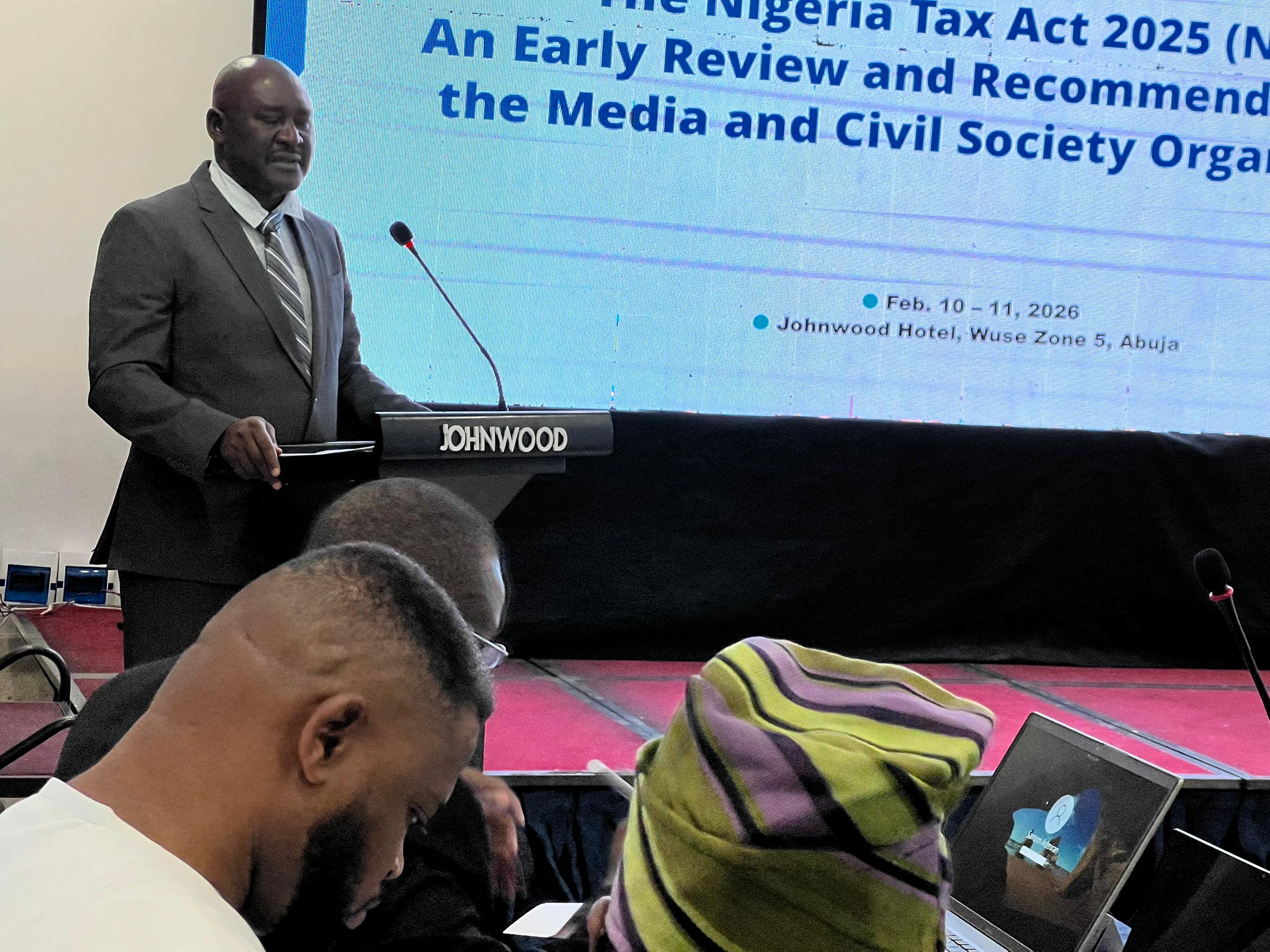

CSOs Demand Fair, Transparent Tax System, Warn Against Multiple Levies

By Oluwakemi Kindness

Civil society leaders have urged the Nigerian government to ensure taxes are fair, transparent, and used for public benefit, raising concerns over multiple levies and weak accountability systems that burden ordinary citizens.

Speaking in Abuja on Tuesday, at a convening on the Nigeria Tax Acts 2025, Executive Director of CISLAC and Secretary of the Tax Justice and Governance Platform, Comrade Ibrahim Rafsanjani, said the challenge is not taxation itself but how it is implemented.

“Ordinary Nigerians face multiple levies while the wealthy exploit loopholes, including repeated tax waivers. We need a harmonised and transparent framework that ensures taxes benefit the people,” he said.

Rafsanjani highlighted the role of civil society in public education, monitoring government spending, guiding compliance, and protecting whistleblowers.

The call comes amid concerns that revenue collected by various agencies is often poorly reported or mismanaged, weakening investment in health, education, and infrastructure.

German Model Highlighted

Senior Programmes Manager at Konrad Adenauer Stiftung (KAS), Samson Adeniran, said effective taxation supports social welfare, citing Germany as an example.

“Without taxes, the state cannot provide basic necessities. Human dignity must be protected through adequate public services,” he said, noting Germany’s constitutional guarantee of a minimum standard of living.

Expert Traces Nigeria’s Tax History

Legal scholar and economic historian, Prof. Adetunji O. Ogunyemi, said taxation is essential for national development but warned against excessive and overlapping levies.

“Taxation is a mandatory tool to fund services like education, infrastructure, and security. The focus should be eliminating multiple taxation, not resisting lawful taxes,” he said.

He traced Nigeria’s tax system to colonial policies such as the Mineral Ordinance (1914), Native Revenue Ordinance (1917), and Company Income Tax Ordinance (1939), noting that taxes historically funded infrastructure and public works.

Speakers agreed that understanding taxation and strengthening accountability are key to sustainable national development.

Written by: Democracy Radio

#CISLAC #DemocracyRadio #KAS #Taxation Comrade Ibrahim Rafsanjani Prof. Adetunji O. Ogunyemi Samson Adeniran

Copyright Democracy Radio -2024