Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

By: Aremu Toyeebaht

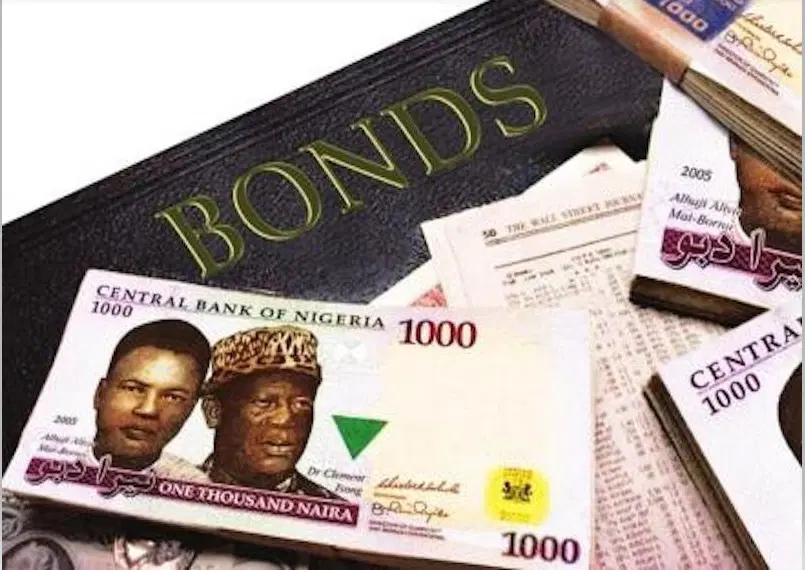

The Federal Government of Nigeria has officially opened subscriptions for its December Savings Bonds, providing investors with a secure opportunity to earn attractive returns fully backed by government credit, the Debt Management Office (DMO) announced on Wednesday.

Two bond tranches are on offer:

-

Two-year FGN Savings Bond maturing on December 10, 2027, offering an annual interest rate of 12.838%.

-

Three-year FGN Savings Bond maturing on December 10, 2028, yielding 13.839% per annum.

“Opening date is December 1, settlement date is December 10, while coupon payment dates are March 10, June 10, and December 10,” the DMO stated.

The bonds are sold at N1,000 per unit, with a minimum subscription of N5,000 and additional units in multiples of N1,000. The maximum subscription per investor is capped at N50 million. Interest is paid quarterly, and the principal is repaid at maturity.

The DMO highlighted that these bonds, like other Federal Government securities, are fully guaranteed, making them a safe investment for both individuals and institutions.

“They qualify as securities in which trustees can invest under the Trustee Investment Act. They also qualify as government securities under the Company Income Tax Act and Personal Income Tax Act, making them tax-exempt for pension funds and other eligible investors,” the DMO added.

The bonds are listed on the Nigerian Exchange Limited and count as liquid assets for banks in calculating liquidity ratios, enhancing their appeal to institutional investors.

Written by: Toyeebaht Aremu

Similar posts

Copyright Democracy Radio -2024