Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

By Oluwakemi Kindness

The National Insurance Commission (NAICOM) has secured the commitment of the Corporate Affairs Commission (CAC) to support the implementation of the Nigeria Insurance Industry Reform Act (NIIRA) 2025, particularly the law’s 12-month recapitalization timeline.

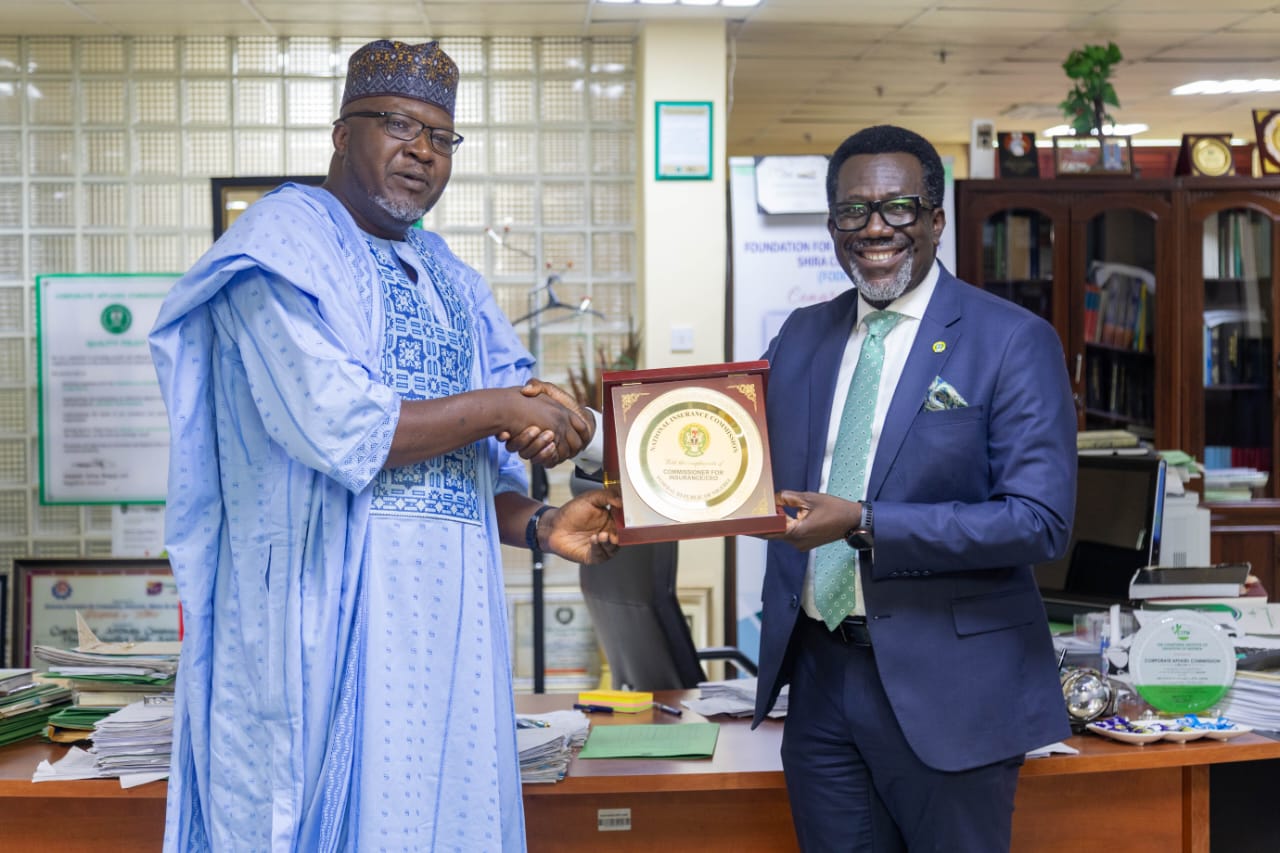

Speaking during a courtesy visit to the CAC Registrar General in Abuja, the Commissioner for Insurance (CFI), Olusegun Omosehin, emphasized the urgency of the recapitalization exercise and the need for smooth inter-agency collaboration to ensure compliance and stability in the insurance sector.

According to a statement released by NAICOM on Wednesday, Omosehin stressed that aligning regulatory actions with the provisions of NIIRA 2025 is critical to safeguarding the industry’s financial health.

He also commended the CAC for its role in promoting corporate governance and advancing business reforms in Nigeria.

In his response, CAC Registrar General, Hussaini Magaji (SAN), pledged full support for the reforms.

He assured NAICOM of expedited clearances, enhanced data-sharing mechanisms, and the issuance of enabling guidelines to facilitate the recapitalization process.

The engagement marks a united regulatory approach in advancing President Bola Tinubu’s economic agenda and driving sustainable growth in Nigeria’s insurance industry.

Written by: Democracy Radio

#CAC #DemocracyRadio #Insurance #NAICOM #NAICOMng

Copyright Democracy Radio -2024