Listeners:

Top listeners:

-

play_arrow

104.9FM Best rock music demo

-

play_arrow

Demo Radio Nr.1 For New Music And All The Hits!

-

play_arrow

Demo Radio Techno Top Music Radio

-

play_arrow

play_arrow

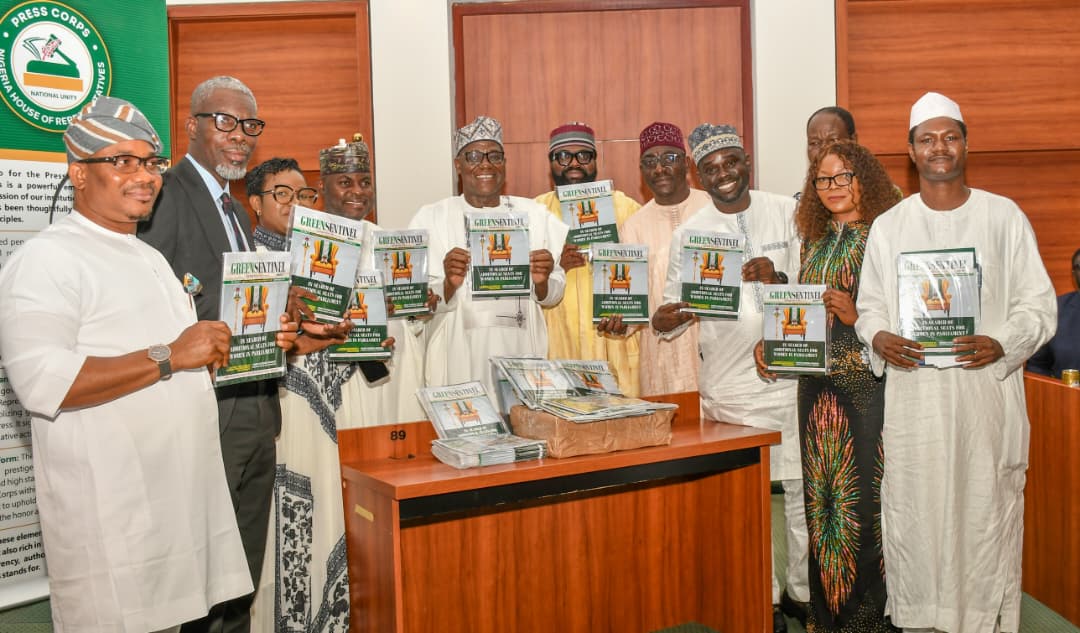

Police Commissioner Launches Weapon and Riot Control Training for FCT Officers Democracy Radio

By Oluwakemi kindness

The Federal Inland Revenue Service (FIRS) has clarified that not all funds deposited in individual bank accounts are subject to taxation.

The recent comment counters widespread misconceptions surrounding the recently passed tax reforms.

Speaking at the inaugural parliamentarian lecture by the House of Representatives Press Corps, Special Assistant to the FIRS Chairman on Tax Policy, Olufemi Olarinde, explained that Nigeria operates a self-assessment tax system.

This places the responsibility on individuals and businesses to declare their income and file tax returns.

According to the official, while taxable income such as salaries, business earnings, and professional fees must be declared and taxed, deposits such as gifts, money held on behalf of third parties, or transfers for non-commercial purposes do not attract tax obligations.

“The law is very clear. It is not every deposit that is taxable. When preparing your financial statements, you separate income from non-taxable deposits.

For example, gifts, family support, or money collected for someone else are not taxable. But if you receive payment for services rendered or business activities, that is taxable,” the official said.

He stressed that the introduction of the new Tax Identification Number (Tax ID) requirement for opening bank accounts is not intended to impose fresh levies on citizens, but rather to enhance transparency, track taxable persons, and ensure accurate reporting.

The tax authority also emphasized that government agencies do not have the power to directly debit citizens’ accounts for taxes.

Instead, assessments are issued when taxpayers fail to make proper declarations, with opportunities provided for taxpayers to respond or appeal.

The official further highlighted that recent reforms provide reliefs and exemptions, including a zero percent tax rate for businesses with an annual turnover below ₦100 million, and the exemption of the first ₦800,000 of personal income for every taxpayer.

“These reforms are not designed to impoverish Nigerians but to broaden transparency and fairness in the system. It is important to move beyond sensationalism and focus on accurate understanding,” he noted.

The new law also establishes the office of the Tax Ombudsman and strengthens the Tax Appeal Tribunal, giving Nigerians avenues to challenge tax assessments and decisions.

Written by: Democracy Radio

#DemocracyRadio #FIRS #House of Reps #House of Reps Press corps #Tax reforms

Similar posts

Copyright Democracy Radio -2024